An 800 credit score is more than just a number—it’s a badge of financial excellence that opens doors to the best interest rates, premium credit cards, and exclusive financial opportunities. This elite credit milestone reflects years of responsible financial behavior, disciplined money management, and a deep understanding of how credit works. For many, reaching this point is a dream come true, highlighting their commitment to maintaining impeccable financial health.

But what exactly does it take to earn an 800 credit score? Is it achievable for everyone? The truth is, with the right strategies and consistent effort, most people can work their way up to this coveted score. While it does require a mix of patience, financial knowledge, and discipline, the benefits of having an 800 credit score far outweigh the effort. From easier loan approvals to lower insurance premiums, the advantages are endless and well worth the pursuit.

In this comprehensive guide, we’ll walk you through the ins and outs of achieving and maintaining an 800 credit score. From understanding the factors that affect your credit score to actionable tips that can boost it, we’ve got you covered. Whether you’re just starting on your financial journey or looking to elevate your existing credit score, this article will serve as a step-by-step roadmap to achieving financial excellence.

Read also:Best Alternatives For Cardamom How To Find The Perfect Cardamom Substitute

Table of Contents

- What is an 800 Credit Score?

- Why is an 800 Credit Score Important?

- How is Your Credit Score Calculated?

- What are the Benefits of an 800 Credit Score?

- Can Anyone Achieve an 800 Credit Score?

- Steps to Earn an 800 Credit Score

- Common Mistakes to Avoid

- How Long Does it Take to Reach 800?

- How to Maintain an 800 Credit Score

- Does an 800 Credit Score Guarantee Loan Approval?

- How Does an 800 Credit Score Affect Mortgage Rates?

- Myths About an 800 Credit Score

- Frequently Asked Questions

- Conclusion

What is an 800 Credit Score?

An 800 credit score is a near-perfect score within the standard credit scoring models, such as FICO and VantageScore. Typically, credit scores range from 300 to 850, with anything above 750 considered excellent. An 800 credit score places you in a league of high achievers, reflecting exceptional creditworthiness in the eyes of lenders.

Having an 800 credit score doesn’t happen overnight. It’s the result of years of consistent financial responsibility, including on-time payments, low credit utilization, and a long credit history. Lenders view individuals with an 800 credit score as low-risk borrowers, which often translates into better financial benefits and opportunities.

What Makes an 800 Credit Score Stand Out?

While a score of 750 is considered excellent, crossing the 800 mark takes your financial profile to an elite level. Here’s why it stands out:

- It signals an impeccable credit track record.

- Lenders trust you to manage debt responsibly.

- You gain access to the best financial products and services.

Why is an 800 Credit Score Important?

Having an 800 credit score isn’t just about bragging rights—it has tangible benefits that can improve your financial life in multiple ways. From saving money on interest rates to securing loans with ease, an excellent credit score can make a world of difference.

Key Reasons Why an 800 Credit Score Matters

- Lower interest rates: Borrowers with high credit scores often qualify for the lowest interest rates on loans and credit cards.

- Better loan approvals: Lenders are more likely to approve loans for individuals with excellent credit.

- Higher credit limits: You may qualify for higher credit card limits, allowing for greater financial flexibility.

How is Your Credit Score Calculated?

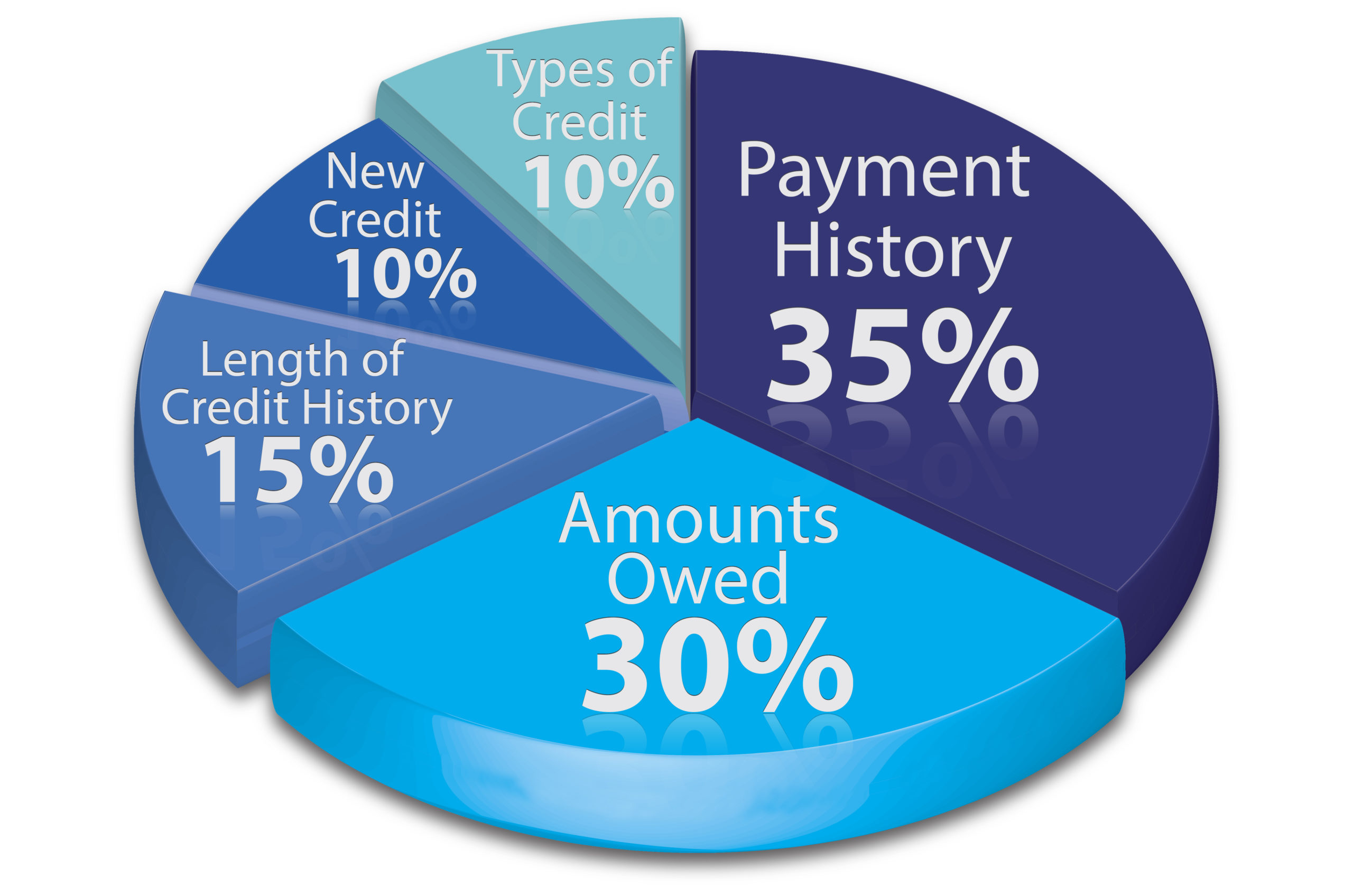

Understanding how your credit score is calculated is the first step toward improving it. Credit scoring models use several factors to determine your score, each weighted differently. Here’s a breakdown:

Factors that Impact Your Credit Score

- Payment history (35%): Paying your bills on time is the most significant factor affecting your credit score.

- Credit utilization (30%): This refers to the ratio of your credit card balances to your credit limits. Keeping this ratio low positively impacts your score.

- Length of credit history (15%): The longer your credit history, the better it is for your score.

- Credit mix (10%): A diverse mix of credit accounts (e.g., loans, credit cards) can improve your score.

- New credit inquiries (10%): Opening too many new credit accounts in a short time can lower your score.

By focusing on these factors, you can develop a strategy to boost your credit score effectively.

Read also:Delving Into The Heart Of The Banana Boat Song A Melodic Marvel

What are the Benefits of an 800 Credit Score?

Reaching an 800 credit score is no small feat, and the rewards are worth the effort. Here are some of the top benefits:

- Exclusive credit card offers: Access premium credit cards with rewards, perks, and low fees.

- Lower insurance premiums: Some insurers use credit scores to determine premiums, and an 800 score can save you money.

- Better negotiation power: With excellent credit, you can negotiate better loan terms and interest rates.

Additional Perks of Having an 800 Credit Score

Beyond financial benefits, an 800 credit score can also provide peace of mind. Knowing you’re in excellent financial standing can reduce stress and give you confidence when applying for loans or credit cards.

Can Anyone Achieve an 800 Credit Score?

Yes, achieving an 800 credit score is possible for most people. While it may take time and effort, there’s no magic formula—it’s all about consistent financial habits and understanding the factors that influence your score.

Who Can Reach an 800 Credit Score?

Reaching an 800 credit score isn’t limited to high-income earners. It’s more about financial discipline than income level. People from all walks of life can achieve this milestone by following best practices for credit management.

Frequently Asked Questions

Can I achieve an 800 credit score without a long credit history?

Yes, while a long credit history helps, you can still achieve an 800 score by focusing on other factors like payment history and credit utilization.

Does an 800 credit score guarantee the lowest interest rates?

Not always. While an 800 score qualifies you for the best rates, other factors like income and debt-to-income ratio also play a role.

How much credit utilization is ideal for an 800 score?

Keeping your credit utilization below 10% is ideal for achieving and maintaining an 800 credit score.

Will closing old credit cards hurt my score?

It can. Closing old accounts may reduce your credit history length and increase your credit utilization ratio, both of which can lower your score.

How often should I check my credit score?

Check your credit score at least once a month to stay informed and catch any potential errors or inaccuracies.

Is it worth paying for a credit monitoring service?

While free tools are available, a paid credit monitoring service can provide additional features like identity theft protection and detailed credit insights.

Conclusion

Achieving and maintaining an 800 credit score is a rewarding journey that brings countless financial benefits and peace of mind. By understanding the factors that influence your score and practicing responsible financial habits, you can join the elite group of high achievers. Remember, consistency is key, and even small efforts can lead to significant improvements over time. Start today, and you’ll be one step closer to reaching your financial goals!

Article Recommendations